According to a Which? Survey in January 2015, 40% of adults received a phishing email pretending to be from HMRC. Recently we’ve had several clients report similar emails to us, all of which state that there’s a tax refund waiting for them, usually of several hundred pounds. All they need to do is log onto their Gateway Account via a handy link in the email and input their bank details. Sounds easy, and sadly many people do fall for it. Phishing emails can look incredibly genuine, and we as taxpayers tend to trust anything that comes from HMRC. The end result is of course nothing but an empty bank account, with personal details being passed on to other scammers.

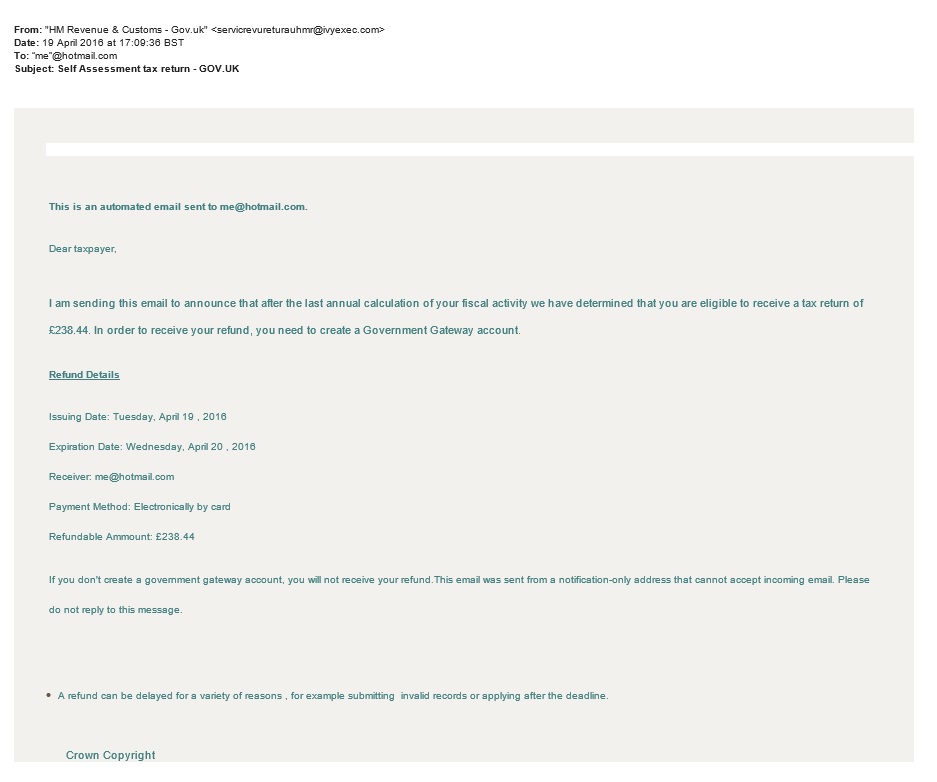

You can often spot a phishing email from the details in it, specifically the spelling, grammar, links (do not click them!) and the email address – in the one below for example you can see the email address is not actually HMRC but servicrevureturauhmr@ivyexec.com and there’s a typo in the text underneath with “Ammount” rather than “Amount”. Again go careful though, it’s possible to spoof a Sent By address to make it look genuine, so don’t assume that just because the sender has a Gov.UK or HMRC email address that they are who they say they are!

HMRC publish a list of current content issued by them here so you can check if the email you received is genuine, along with some more details on how to recognise a phishing email.

You should also send the email to HMRC so that they are aware of it and can publish it for others to beware of, and include it in their list of current scams. The email address to use is phishing@hmrc.gsi.gov.uk

What should you do?

If you get an email purporting to be from HMRC please send it to your tax adviser and ask them to check it, even if you are actually expecting a tax refund. Do not click any links in the email or open any attachments as they may contain a virus.

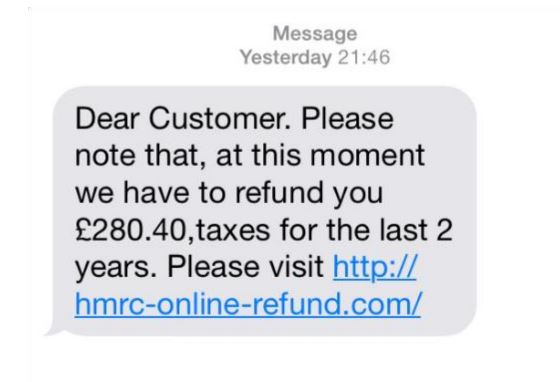

HMRC will never email or text you telling you about a refund. If a refund isn’t notified via post or through your Gateway, it’s fake.

Most of us will actually rarely hear from HMRC at all, and if you do it will be something generic about deadlines for tax returns or an upcoming webinar, never anything asking for personal details.

If you don’t have an adviser or want to check your tax position yourself then go direct to the Gov.UK website and login to your Gateway Account there, do not use any links provided in an email. If you do not have a Gateway Account then take 5 minutes to set one up, it may come in handy in future if you need to check your tax position and you can also file certain tax related forms which is quicker than posting them. Your Gateway account can be used for DVLA related tasks too such as change of address on your driving licence.

If you have a company you are also able to set up a Gateway account for it, which is incredibly helpful for checking and filing Corporation Tax, VAT and PAYE. HMRC provide more information through a company Gateway Account than they provide to your Adviser through their Agent Gateway Account, and it will enable you to keep an eye on documents that have been filed, deadlines and tax due/repayable. Even if you trust your adviser, which you should or you’re with the wrong one, it’s still your legal duty as a Director to know what’s going on.

Talk to your adviser about setting up an Account if you’re not sure how to proceed, and make them aware of any correspondence you receive from HMRC so that they can advise you appropriately – it’s what they’re there for after all!

Please note that this blog is intended as an overall introduction to the subject matter, and should not be taken to be exhaustive or specific advice. You should discuss your individual personal circumstances with your own professional adviser before taking any action.