Are you a buy-to-let landlord? Or thinking of becoming one? If so, there have been some very important tax changes announced recently that you need to be aware of.

Capital Gains Tax

The March 2016 Budget announced that the rate of Capital Gains Tax will be reduced on many gains, with the noted exception of second properties. Upon sale any gain will continue to be taxed at 28% in higher rates and 18% in basic rates.

In 2019 the payment of Capital Gains Tax will be accelerated too, and will be due within 30 days rather than on the usual tax payment dates following the year end.

Stamp Duty

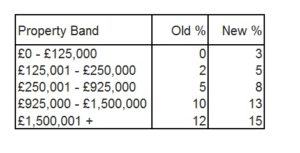

From 1st April 2016 there will be a 3 percentage point surcharge for buy-to-let properties, and those buying a second residential home, whether they buy personally or via a limited company. The only properties excluded from this new charge are those valued at under £40,000, caravans and houseboats.

The higher rate of tax will apply to married couples and civil partners if one person in the relationship already owns a property, as they are effectively treated as a single person for SDLT (Stamp Duty Land Tax) purposes.

Mortgage Interest

From 6th April 2017 new measures will be introduced (spread over the course of 4 years) that will restrict finance costs allowable to a flat 20% income tax credit. Landlords will no longer be able to deduct all of their finance costs from their property income to arrive at their property profits, instead they will instead receive a basic rate reduction from their income tax liability.

In 2017 to 2018 the deduction from property income (as is currently allowed) will be restricted to 75% of finance costs, with the remaining 25% being available as a basic rate tax reduction.

In 2018 to 2019, 50% finance costs deduction and 50% given as a basic rate tax reduction.

In 2019 to 2020, 25% finance costs deduction and 75% given as a basic rate tax reduction.

From 2020 to 2021 all financing costs incurred by a landlord will be given as a basic rate tax reduction.

Wear & Tear Allowance

From April 2016 the Wear & Tear Allowance, which allowed a straight 10% deduction of rental income to offset the “wear & tear ” of furnishings for some landlords, will be replaced by a new system. The new system only allows a deduction of actual costs incurred on replacing furnishings. The positive side of this is that a landlord won’t need to decide if he’s eligible for W&T anymore, the new system applies to everyone. The negative side is that tax relief for deterioration of furnishings will be withheld until said furnishing is replaced in full, and there will be no relief at all for the original purchase cost.

These changes will therefore mean that buying an empty property and furnishing it will mean no tax relief, whereas buying a property with old furniture and replacing it will enable a relief claim. This should be considered when looking for a property to buy as it could make a significant difference.

What next?

If you already own a property and need help in declaring your rental income to HMRC, or just want some advice on how these changes effect you and what you can do to mitigate the tax, then give us a call or drop us an email. We can help with all aspects of UK tax and accounting – contact us to see how we can help you!

Please note that this blog is intended as an overall introduction to the subject matter, and should not be taken to be exhaustive or specific advice. You should discuss your individual personal circumstances with your own professional adviser before taking any action.